|

|

|

|

|

|

|

Copyright © 2012 by Wayne Stegall The 90/10 Rule

|

|

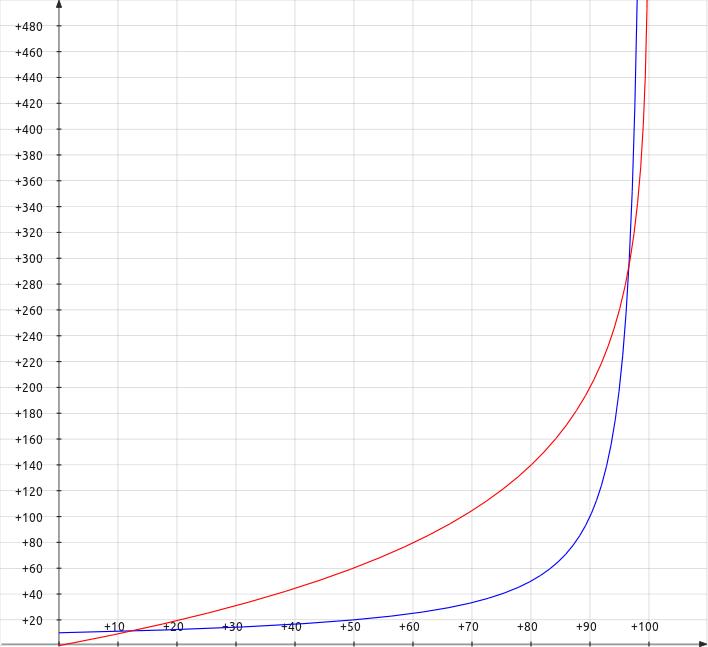

| Legend: Horizontal axis: Wealth ranking in percent. Vertical axis: Approximate income in $1000 units. Blue curve: Modeled income from 0 = $15k to 100 = richest based on the inverse model. Red curve: Integral of income curve represents increase in tax base as progressively more rich are required to pay. (Not to scale) |

Now someone is going to say that the rich can support everyone. However there is no wealth for anybody if no one is working to create the prosperity that these relations suggest. If anyone is cheated at any point along the curve everyone loses. If the rich are cheated, there is no incentive for anyone to become entrepreneurs, to become rich, to do those things that raise the whole curve. In an interactive economy where those at the bottom of the curve buy the majority of the goods, cheating those at the bottom also deprives the rich who now have no one to whom to sell their goods. If everyone's prosperity is benefited by upward mobility, there must evenly distributed incentives without obstacles at every point along the way. This calls for fair treatment of everyone. Tax schemes with sudden jumps at any point inhibit upward mobility at those very junctions. This seems to suggest taxing everyone at the same rate, perhaps 9% or less. As the graph shows that the rich can pull more weight, including everyone without loopholes would enable a rate low enough to deter anyone from trying to cheat the system. The reason our tax code is corrupted with loopholes is that the rich fear Socialists will steal all of their money. If I were a small businessman, I would not want to build a business then lose it to a 50-75% estate tax after having been penalized with high taxes for having the initiative to create prosperity for me and my employees. Robin Hood was a criminal!

Altruism is great in many ways. However altruism does not pay the bills and usually provides no motive to build a successful economic enterprise. Some degree of self-interest is necessary to move everyone up on this curve. Artificial economic schemes that subvert self-interest subvert prosperity as well. This necessity to exploit self-interest makes Socialism a mirage. It seems right in the eyes of its believers but eventually destroys its economic base. In this light the curve that shows the disparity between the rich and poor to some should be viewed instead as one showing the path to upward mobility and prosperity.

What about the poor? Giving long term charity without requiring the poor to work for it traps them by subverting their natural self-interest to get out of poverty. Also, it seems that self-interest on the part of the rich by default leaves the poor to work long hours in sweat shops for little pay. With no middle class there really is no one to buy the goods that create prosperity because the rich tend to hoard their money and the poor are not able to buy enough to operate the system. A system of self-interest serves here too. That is organized labor. Unions are currently as badly stigmatized as the rich and corporations because like the others they have become corrupt. However, I doubt that America would ever have had a middle-class large enough to make us all prosperous if organized labor had not been a force to counter the greed of the rich. Union activity has even raised the wages of non-union workers. As a conservative, I am no big fan of big labor: it is not lost on me that union abuse has crippled industrial productivity to the near extinction of some corporations. This disparity exists because unions have been given in many states monopoly powers that would result in anti-trust actions if practiced by corporations. How many enterprises are given the privilege to monopolize all the labor in a state and have dues mandated by undemocratic legislation. If unions were classified as corporations providing a service, that service being collective bargaining and made subject to the same anti-trust laws as other corporations, a more level playing field would result.

At this point you might think of the political solutions this argument would raise. However, economics is not scientifically solvable and depends as much on faith and perception as other factors. In this uncertain context, God declares that He is the true source of prosperity.

But

thou

shalt

remember

the

LORD

thy

God:

for

it

is

he

that

giveth

thee

power to get wealth, that he may establish his covenant which he sware

unto thy fathers, as it is this day. (Deut 8:18)

America's prosperity as we knew it was a blessing from God. It had momentum to continue for a good while in spite of national sins which were eroding its foundation. Now we have to choose. God is where he has always been with a blessing in his hand. Our sin however has put a separation between us and Him that prevents us from grasping it. Now is the time to let go of the bonds of poverty to grasp that which is better. Voting sin-activists out of office is therefore essential to the long-term welfare of our country in this and other ways. Just do it.

|

|

Document History

May 18, 2012 Created.

May 18, 2012 Corrected some grammer, improved some wording, and added to legend of graph.