InfoVis 2005 Contest

Boom

and Bust of Technology Companies at the Turn of the 21st Century

Contest webpage: www.public.iastate.edu/~hofmann/infovis/

Authors and Affiliations:

- Heike Hofmann, Iowa State University, hofmann@iastate.edu

- Hadley Wickham, Iowa State University, hadley@iastate.edu

- Dianne Cook, Iowa State University, dicook@iastate.edu

- Junjie Sun, Iowa State University, jjsun@iastate.edu

- Christian Röttger, Iowa State University, roettger@iastate.edu

Tools:

- R especially packages RMySQL, maps,

maptools, RColorBrewer, ash

- GGobi

- MySQL

- Manet

Data description

This data contains information on 84472 technology companies between

1989-2003. The companies produced 154912 unique products in this period. This

period of time is notable for technology innovations such as the rise of the

internet, the dot-com bubble and crash, Y2K, the 9/11 tragedy and changes

between democratic and republican control of government.

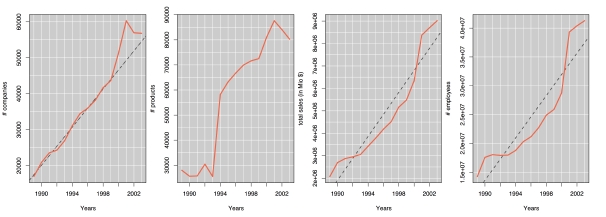

TASK 1: Trends and multivariate relationships

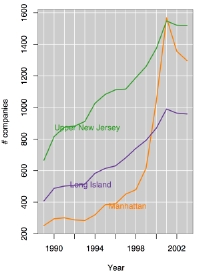

1.1 Trends in technology companies and products over time

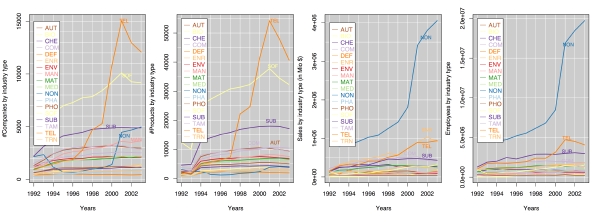

1.2 Trends by industry type

- Process: Each of the variables is tabulated by industry type and

year. Results are plotted as overlaid lines in separate plots for each

variable. The timeline starts at 1992 because the industry type is not defined

until then.

- Image:

- Insights:

- Companies: There is a dramatic increase in the number of

telecommunications companies in 1999 to a peak of 650 million in 2001. The

number of software companies is high throughout the time period, with a

sharper rise 2000-2001 and then a drop. Subcomponent companies were the

second highest industry type until 1999, and the number of these companies

levelled out at 200 million from 1998. A curiousity is the industry type NON

(primarily non-technology companies). It has a suspiciously political

pattern: the number of NON companies drops at the beginning of Clinton's

years and stay low until 2000.

- Products: The number of products by industry type is very similar to the

number of companies.

- Sales: The dominating industry type for sales for the entire period is

NON (primarily non-technology companies). This is a surprise because we

would not have expected this seemingly miscellaneous industry type to be

dominant in sales. Perhaps these are companies that have a broad variety of

products, of which technology products are a subset, but sales are recorded

across all. There is a dramatic increase in sales for this industry type

after 2000. The next two largest categories in sales are telecommunications

and energy.

- Employees: The patterns for employees follows those for sales, in

primarily non-technology companies and telecommunications. Subcomponent

companies are the second biggest employers until 2000 when they get bumped

by telecommunications.

- Caption for exhibit: Overview of number of companies, products,

volume of sales and number of employees by year and industry type.

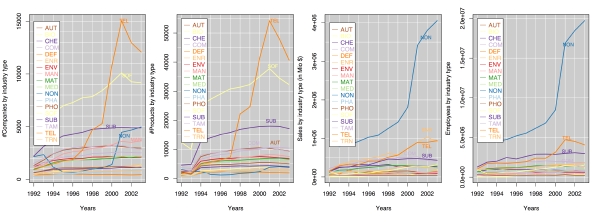

1.3 Is there anything between the East and West Coast?

- Process: The density of company counts was computed with respect to

geographic location, for each year. The results are displayed as colored maps

and animated over time.

- Image:

- Insights:

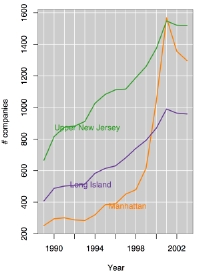

- Results in absolute scale give insights into the geographic areas that

dominate the country - ie the East Coast and California. Apart from that,

Seattle, the Twin Cities, Chicago and Houston are visible.

- Steady growth is visible along the East Coast between Boston and

Washington D.C. as well as on the West Coast in San Francisco and Los

Angeles until 2001. After 2001 this trend inverses and these areas fall

victim to huge decreases in the number of companies.

- Losses in the East are localized with their center in Manhattan.

Manhattan loses 14% of its technology companies in 2001. Close by areas such

as Long Island and Upper New Jersey do not show similarly dramatic losses.

- Caption for exhibit: Growth and decline in number of companies by

geographic location are displayed on a map of the U.S. Steady growth in the

number of companies occurs along the East Coast and California. After 2001

these areas show huge losses in the number of companies. The losses along the

East Coast have their center in Manhattan, which loses 14% of all of its

technology companies.Center of the losses on the West Coast is San Francisco -

16% of all companies are gone until 2002. Losses on the East Coast are

different insofar, as dramatic losses are restricted to Manhattan, whereas

both Long Island and Upper New Jersey see only very slight losses in the range

of less than 10%.

TASK 2: Clusters

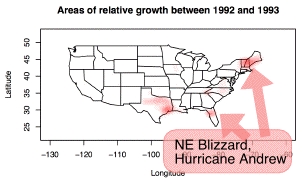

2.1 Is local growth fueled by natural disasters?

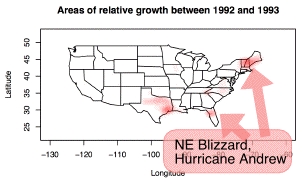

- Process: The density of relative company counts was computed with

respect to geographic location, for each year. The results are displayed as

colored maps as small multiples and animated over time. Relative growth is

measured as the difference in the number of companies of two consecutive years

divided by the number of companies in the earlier year.

- Image:

Animated

gif

Animated

gif

- Insights:

- The relative scale tells about pockets of locally dramatic increase in

technology company activity.

- Some of these pockets seem to coincide with weather related disasters -

between 1992 and 1999 all but one area can be matched with floods,

hurricanes and other mostly weather related disasters. This points to

federal emergency funds as a stimulant for local growth.

- Relative growth is high in various areas between 1998 and 1999. This

coincides with the boom of internet/web related technology.

- Caption for exhibit: The density of relative company counts was

computed with respect to geographic location, for each year. Results are

displayed as colored maps and animated over time. The relative scale reveals

pockets of locally dramatic increase in technology company activity. Many of

these appear after natural disasters.

- Supporting

information

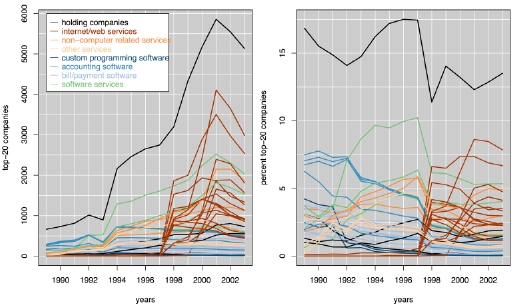

2.2 Software is out -- services are in

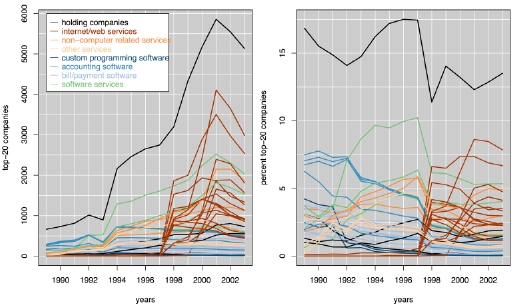

- Process: Top 20 products were picked for each year, where top

products were defined to be those products offered by the most companies. The

development of each of these products is shown between 1989 and 2003 in

absolute number of companies (left) and their relative market share (right).

- Image:

- Insights:

- Top products are very stable - between 1989 and 2003 only 45 different

products appear among the top 20 products at least once.

- The number of companies offering one of the top products increases over

time, indicating that market competition is becoming stronger.

- Products can be classified mainly as either service or software. The

number of companies offering software products is very stable over time, the

number of companies offering service products increases dramatically over

time. Companies offering internet/web related services take the market by

storm after 1997. After 2001 the number of companies offering services

decreases for all products, following the general trend of the market.

Software companies do not follow this trend but remain stable.

- "Losers" are companies offering custom application software, "winners"

among software products are software services.

- Top 20 services offered from the beginning of the time period are

non-computer related: waste management, soil or water analysis.

- Holding/parent companies are ranked number one throughout the time

period.

- 1993 wasn't a good year for high-tech products - the number of companies

takes a dip across all top products. .

- Caption for exhibit: Line plots of top products between 1989 and

2003. Products shown are among the top 20 products (i.e. products offered by

the most companies) at some time between 1989 and 2003. Shades of orange

indicate services, shades of blue indicate software products. The three green

lines are software services. Black lines correspond to holding companies.

Overall, the number of companies offering one of the top 20 products increases

(sign of higher competition?). Early on, most products are software related

products - after 1997 services dominate the market. Custom programming

software products seem to take the worst dip of all - they seem to drop out of

fashion after 1991. While other software products still increase slightly,

they do not experience the boom of service products. The only software

products that do particularly well are software services (green lines), which

seem to jump on the service bandwagon. On the other hand, software products do

not seem to suffer from the same decrease after 2001 as almost all of the

service products. The dark red lines are internet/web related products. They

exist only after 1997 (some relationship with Windows 97?) and take the market

in a storm. Orange colored products correspond to non-computer related

services, such as waste management, soil analysis and water analysis. These

services existed from the beginning of the time period and remain among the

top 20 products throughout.

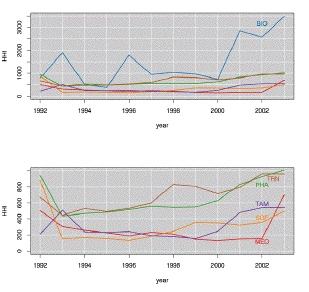

2.3 High market concentration in biochemical companies

TASK 3: Unusual features

3.1 There's something strange about Harris County, Texas!

- Process: The numbers for each county for each year are aggregated

yielding summary statistics for each county: number of companies, number of

employees, volume of sales, number of products, number of different products.

Summary statistics over the time period for each county are produced to

characterize the longitudinal data. Geographic location, using latitude and

longitude, is added to the county summaries. The data is compiled into an xml

metadata set for ggobi, so that different aspects of the data can be probed

quickly. The strange pattern in Harris County was investigated further by

making detailed calculations in R, subsetting the data into just Harris County

and making further calculations.

- Image:

- Insights: Most counties follow a pattern of increasing number of

companies over time, and a strong drop after 2000. There is one noticeable

expection to this pattern: Harris County, TX. This county has a dramatic

increase of 110 companies from 2000-2003, which represents a 14% increase.

There is only one other county with an increase or more than 10 companies

during this period. Is there something unique in Harris County, TX? Harris

County, TX, is the home of the Johnson Space Center. It is also the county

where George Herbert Walker Bush claims a homestead exemption on his

residence. The increase in number of companies is explained mostly by a 50%

increase in energy companies, from 117 to 172, with 26% (62 to 91) explained

by primarily non-technology related companies. (Aerospace companies are

included in this industry type.) Sales and number of employees increase from

2001-2003 but not so much differently from other counties. The number of

different products jumps, and this is noticeably different from other

counties.

- Caption for exhibit: Harris County, TX, has a noticeably different

trend than all other counties after 2001. The number of companies in the

county actually increases, by 110 companies from 800, by 14%. It is the home

of the Johnson Space Center, and also of G. H. W. Bush.

- Supporting

information

3.2 Sales switch up between counties in Detroit, MI

- Process: The same county aggregated data is used, focusing on

sales. The extreme values are sequentially filtered by hiding the county with

the highest sales in the plot. (This includes New York County, NY, Cook

County, IL, Hennepin County, MN.) A strange pattern was revealed and we

investigated this by highlighting the counties involved and zooming in on a

map to explore the geographic location.

- Image:

- Insights: One county, Wayne County, MI, has a strange sales

pattern. It has strong but flat sales from 1989 to 1997, and then drops

dramatically. On closer inspection there is another county with the inverse

pattern, which is Oakland County, MI. Both counties are in Detroit, MI. The

switch is observed in the zoomed map view of the state: from 1997 to 1998 the

high sales switch from Wayne to Oakland County. One reason for this switch

might be the activities of the Mayor, Dennis Archer.

- Caption for exhibit: Wayne County and Oakland County, MI swap the

dominance of sales between 1997 and 1998.

- Supporting

information

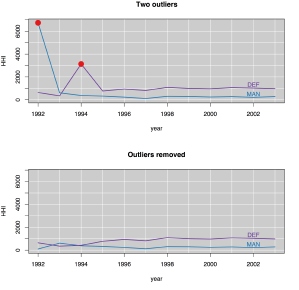

3.3 Strange Values for Market Concentration

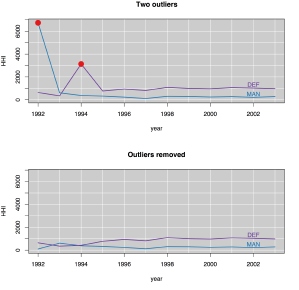

- Process: The HHI (introduced in Task 3) is plotted against year.

Results are displayed as line plots, with and without the outliers. Further

calculations are made to check the data.

- Image:

Two outlier values (red dots in top picture) excluded in bottom

picture

- Insights: Two industry types, MAN and DEF, stood out by exhibiting

sudden, huge jumps in 1992 and 1994, respectively. The results were

recalculated after excluding the two sales values which caused the jumps. In

both instances, one firm has ten-fold increases in sales for one year,

followed by a fall back to original levels the next year. This gives it a

near-monopoly HHI score for that year explaining the HHI spike.

We might be tempted to speculate about the NATO mission in Bosnia etc. But

the high sales represent a tenfold increase, falling the year afterwards to

the former level and staying there. Therefore we suspect errors in data entry

here.

- Caption for exhibit: HHI is plotted against year measuring the

amount of market concentration. There are two extreme values in industries MAN

and DEF. Together with the fact that the high sales figures are strictly

one-off, a tenfold increase followed by a fall back to original levels, we

suspect an error in data entry here.

TASK 4: Other findings

Data cleaning

We spent of lot of energy early in the data release

finding anomalies in the data and reporting these. This resulted in numerous

revisions of the competition data. Some of the problems were fixed but there

still seem to be numerous problems with this data. WIth data sets of this size,

mainting quality is a very difficult problem. Here are some of the

irregularities we found:

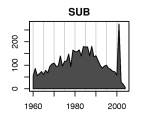

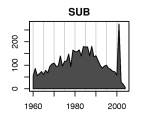

4.1 Can so many companies really be founded in 2000?

- Process: The counts for companies founded are plotted against

years, together and separated by industry type.

- Image:

- Insights: There is a big spike in number of companies founded in

the year 2000. This doesn't look plausible. It exists before and after the

final data cleaning for the competition. The spike exists for every industry

type. In the original data the number of companies founded in 1999 is 4081 and

it jumps to 13433 in 2000. In the cleaned data the number of companies founded

almost doubles from 4132 in 1999, to 7352 in 2000, and then drops to 804 in

2001. This is extreme behavior!

- Caption for exhibit: Counts for companies founded are plotted

against years separated by industry type. The year 2000 has an implausible

spike in number of companies founded, across industry type.

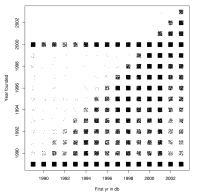

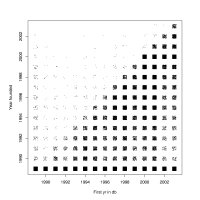

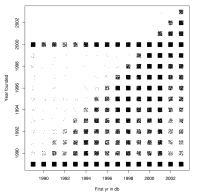

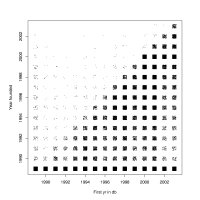

4.2 Why are there companies in the database before it is founded?

- Process: Founding year is plotted against the first year in the

database. The values are jittered slightly to spread ties apart.

- Image:

- Insights: Notice the points above the diagonal, in the upper left

half of the plot? There are many companies founded after they appear in the

database. Year 2000 is particularly problematic. The left plot shows the

original posted data, which has more problems. The right plot shows the final

competition data after cleaning. After the data cleaning, there are still 504

companies that appear in the database before their founding year.

- Caption for exhibit: (Left) Data before final cleaning. (Right)

Data after final cleaning. Founding year plotted against first year in the

database, with ties jittered slightly. There are many companies who appear in

the database before they are founded. In the revised data set this got

improved but still exists.

Conclusions

We were very surprised by many of our

observations on the data. Initial disbelief was followed by intensive number

crunching to check the values and extensive internet searches to find plausible

explanations. Particularly, the potential relationship of local growth in

companies with natural disasters and the increasing trend in the number of

comapnies in Harris County, TX, did come as surprises.

We arrived at the association of natural disasters and local hot spots by an

astute observation by one of the team members. The chaotic popping up of hot

spots around the country looked spurious, until one person asked at the 93-94

hotspot in Iowa: "When were the floods in Iowa?" This led to extensive searches

of geographic locations and natural disasters, and it cascaded into ways to

explain many hotspots. Mostly, these could be found in the 93-99 period when

Clinton was in government. Only then we started to come across accusations in

online news stories about suspect use of FEMA funding during the Clinton

administration. Letterman cracked a top 10 joke related to FEMA. Not all of the

hotspots can be explained this way. We would also like to point out that this

association between local economic activity and disasters is purely a proposal,

not a conclusive finding.

The results on Harris County, TX, arose immediately from the longitudinal

plots of county counts. The trend stands out in the graphic, in a manner

probably not so detectable numerically. Checking the numbers and finding no

other county in the USA that is even close to this trend was also a surprise.

Identifying it as a county in Texas, was a tad surprising, and even further

surprising to find accidentally that it is the residence of the current

president's dad. There are many attractions, such as the Johnson Space Center,

in Harris County, but this association raises big questions about political

influence.

When we started exploring the data, we expected to see the bubble pop in

Silicon Valley, some economic effects in the New York region after September 11,

2001, the effects of Microsoft developing in the Seattle area. And we saw these.

We also had other expectations that did not pan out: companies that move a lot

might be more likely to go bankrupt (disappear from the database), that there

might be movement from away from the coasts after the bust to the mountain

states and the Midwest. There is some movement of companies but these results

were less interesting.

Comments

Thanks to Georges Grinstein, Urska Cvek, Mark

Derthick and Marjan Trutschl for such intriguing data, and the enormous amount

of work that was clearly needed to pull it together.